Welcome back to our monthly wrap up where we share updates regarding Liquity and our ecosystem.

UST Implosion

It seems like a distant memory now, but one of the craziest occurrences in crypto history happened earlier this month with the implosion of TerraUSD (UST). The implosion wiped over $50 billion of TVL on the Terra blockchain alone, and has served as a great reminder of the importance of using safe DeFi. UST is currently trading at 0.03 and has completely collapsed.

As the issue at hand is way more complex than what this monthly roundup can handle, more can be read on these threads that are detailed here:

- Nansen article

- Jack Niewold thread

How did $LUSD perform during all this?

As seen from the Coingecko above, $LUSD did a fantastic job at holding peg. $LUSD barely deviated over the $1.02 mark, upon which it promptly returned back to peg.

We can get a better understanding of the stability by comparing the $LUSD price with that of other stablecoins like DAI, USDC and USDT based on the Curve LUSD-3CRV pool

The above chart makes it clear that LUSD struck a middle ground between USDC and DAI that suddenly appreciated on May 12th, while USDT lost value.

Reactions from the Crypto Community

As the wiping of over $50billion in value is bound to bring more scrutiny from regulatory eyes, it is now more prudent than ever to spend time learning about the actual decentralized stablecoins. Not all stablecoins are created equal; many are DINO (decentralized in name only), and very few out there have gone through multiple market drawdowns and have stood the test of time ;)

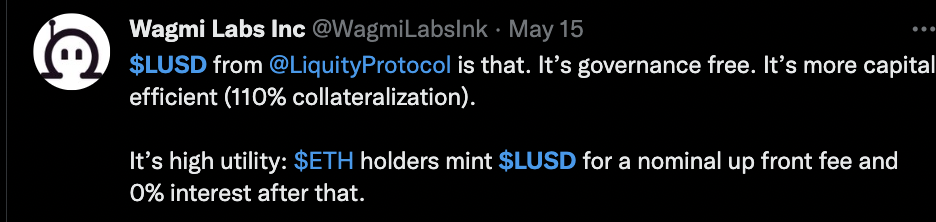

Here’s a decent idea of what the crypto twitter crowd thought of LUSD while the furore went down

Needless to say, the stability was much appreciated!

TokenBrice joins the Liquity team

With his experience and connections in the space, TokenBrice has joined Liquity to help with increasing Liquity's footprint in the DeFi ecosystem, and improve our communications and outreach

He has joined our team as Head of Marketing, focused on an upcoming product.

TokenBrice has been involved with DeFi since its infancy. Three years ago he created DeFi France, one of the leading and savviest French-speaking communities. He researches DeFi protocols and shares his findings on his blog. He’s been a Liquity user and vocal supporter since discovering the protocol about a year ago.

DeFi/CeFi Adoption

Liquity is No.1 on Defi Safety!

Amidst all the furore surrounding the past week, it was great to see that Liquity came up trumps with the highest security standards rating of all dApps on Defi Safety. As recent events show, security is the #1 aspect needed in all of DeFi, and we are proud to have been recognized for it.

Spend LUSD using your MOVER Card

One of the key DeFi goals is to bridge the gap between the real world and the on-chain world, and Mover is helping to do just that! You can now spend your LUSD with a MOVER card.

Mover is a project at the convergence of DeFi, NFT, and banking. It provides its users with a "Beautiful Card" that can be funded from their Mover account with various tokens, including LUSD, while also providing users with the ability to move LUSD from a Web3 wallet to a bank account in one go. The card can be ordered by any resident of the EEA: the 28 countries of the European Union and the UK, Norway and Iceland

Please have a read through the work they have done through their FAQ section here and learn more about their bank use case here.

DeFi Saver Stop Loss saves the day!Defi management and tracking software Defi Saver lived up to its name this week through its new automated liquidation protection system. By helping two troves worth $3.9m & $1m respectively, the automatic stop loss feature worked as intended. The Etherscan links to the two troves can be found here, while you can learn more about the automated strategies that Defi Saver offers for Liquity here. Great to see the wider crypto community coming up with innovative solutions to ensure users can sleep easy at night!

DeFi News & Integrations

DefiLlama - DefiLlama have added LUSD on their stablecoin Dashboard. The list can be viewed here.

Hal XYZ - Liquity is happy to announce a partnership with Hal.XYZ to bring you collateral ratio notifications. You can now track your collateralization ratio for any address, and receive notifications for your trove to avoid liquidations.

Velodrome - To join in on the party that is #L2022, $LUSD will be tradeable on Velodrome, an upcoming AMM on Optimism.

Media & Content

Ethereum Audible - Liquity founder Robert Lauko sat down with Ethereum Audible to discuss the Liquity in great depths in a compelling podcast.

Realvision - Liquity founder Robert collaborated with Ben at Real Vision to discuss the Liquity protocol and the functionalities that it provides its users.

Forta - Robert and Bingen spoke with Forta Network to discuss the ways in which Liquity developers utilize Forta to ensure security is optimized across the protocol.

Permissionless 2022 - Ashleigh Schap attended a panel at Permissionless 2022 to talk about the growing Ethereum ecosystem.

Swisspreneur - Robert joined Switzerland’s No.1 podcast for entrepreneurs, Swisspreneur, to discuss his background in cryptocurrency and all things Liquity.

LUSD Appreciation

With the controversy around algostables and stablecoins breaking peg, it was great to see figures within the crypto twitter community come together and recognize the stability of Liquity & LUSD.

Lastly, a tweet from Liquity founder Robert on stablecoins and the importance of delineating between coins that are undercollateralized & being fully collateralized:

Get in touch: Website | Twitter | Discord | LinkedIn | Telegram | Github | Reddit